Partition Sale of Property: Your Definitive Guide to Resolving Co-Ownership Deadlocks

When co-ownership of real estate leads to a permanent, intractable dispute, the law provides a clear, decisive mechanism to terminate that ownership: the partition action.

Within the realm of partition, the sale method is the most common, powerful, and practical, particularly in modern disputes over residential and commercial property division.

This partition by sale guarantees that each party receives a fair share, and as a result, co-owners view it as the best procedure for converting their shared property into cash. It even provides a legal means to resolve conflicts and free a co-owner from the influence of other uncooperative owners.

To protect their financial interests and make informed decisions, individuals need to understand how partition by sale works.

Definition and When Partition by Sale Applies:

A court-ordered legal procedure known as a partition by sale is one in which a shared property, such as a house, apartment, or commercial building, is auctioned on the open market. Once the sale is completed, the remaining funds after deducting the mortgage, taxes, and sale costs are divided between the co-owners.

The fundamental principle governing this action is the absolute right to partition. No individual can be forced to stay in co-ownership of property against their will.

The function of the court in a partition action filed by one co-owner is to legally terminate the property relationship in the fairest way possible, not to mediate a personal conflict.

If you’re dealing with a co-ownership dispute and require clarity on whether partition by sale applies to your situation, contact us. Our experienced and qualified partition lawyer can guide you through the process and protect your interests.

The Impracticality Test: Why Sale is Preferred

While the law technically allows two types of partition (partition by sale and partition in kind), the vast majority of courts order a sale under the Impracticability or prejudice test.

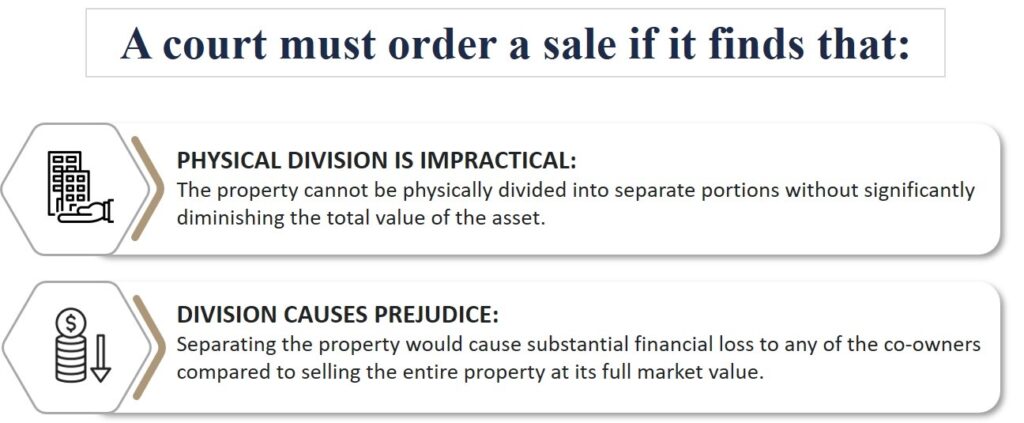

A court must order a sale if it finds that:

- Physical Division is Impractical: The property cannot be physically divided into separate portions without significantly diminishing the asset’s total value. For instance, dividing a single-family house into two separate, independently valuable places is nearly impossible.

- Division Causes Prejudice: Separating the property would result in substantial financial loss for any co-owner compared to selling the entire property at its full market value.

Since partitioning a single residential lot or most improved properties usually results in a dramatic loss of overall market value, the court often concludes that a partition by sale is the necessary and most equitable solution. It ensures all parties receive their share based on the highest possible sale price.

Common Scenarios Requiring a Partition by Sale

A forced sale becomes necessary when a dispute arises in the following high-stakes scenarios:

1. Heirs and Inherited Property

Siblings or other family members inherit a property; one party wants to sell their portion, while another seeks to retain it (but cannot afford to buy out the others).

2. Unmarried Partners

Domestic partners who own a home alone, and one party declines to sell the property or work with a sale listing.

3. Non-Contributing Owners

A co-owner who refuses to pay their share of the mortgage, taxes, or insurance, or lives rent-free. This forces the contributing owner to carry the financial burden alone.

4. Investment Deadlock

Business partners or real estate investors cannot agree on the price, the timing of a sale, or additional investment into the asset.

Court-Ordered Partition Sale Process

The partition by sale is a structured civil lawsuit that requires meticulous adherence to court rules and procedures. The lawsuit aims to get the court order needed to force the sale and manage the financial accounting, not the sale itself.

Step 1: Filing the Complaint

The process starts with a co-owner (the Plaintiff) filing a Partition Complaint in the county court. The complaint lists the ownership shares of each individual, identifies the property, and explains why it cannot be appropriately distributed or sold by consensus. The other co-owners (Defendants) are then officially informed and allowed to respond.

Step 2: Interlocutory Judgment

The court passes an interlocutory judgment after the response from the other co-owners (defendants). This confirms the plaintiff’s right to seek a partition and determine the most equitable answer in a sale. It also establishes the legal processes governing the sale of the property.

Step 3: Appointment of the Partition Referee

The court next designates a neutral Partition Referee to oversee the selling process. The Referee conducts an independent property division assessment, engages a broker, oversees marketing and bidding, and reports all actions to the court.

Step 4: Court Approval of the Sale

Once the Referee gets an acceptable proposal, they present it to the court for authorization. Before finalizing the transaction, the judge reviews the market value of the property and confirms the fairness of the sale. After approval, the sale proceeds and the closing are completed under the Referee’s guidance.

Distribution of Proceeds: The Final Financial Reconciliation

After escrow closes, the sale proceeds are not distributed immediately. They are first placed in a trust account controlled by the Partition Referee or the court clerk, pending final financial reconciliation.

The final distribution order is determined by the court in the Final Judgment of Partition and strictly follows this hierarchy:

1. Court-Ordered Costs:

The administrative costs of the lawsuit include the Partition Referee‘s fees and expenses and the listing broker’s commissions.

2. Secured Liens:

Payments to secured creditors, such as the outstanding balance on the existing mortgage or any judgments recorded against the property.

3. Judicial Accounting Adjustments:

All credits and expenditures due to co-owners are accounted for and reimbursed.

4. Distribution of Net Equity:

Co-owners share the remaining sale proceeds in proportion to their ownership interests, for example, 50/50 or 60/40.

Handling Disputes: The Judicial Accounting Phase

The most critical and often complex component of the entire Partition Action is the Judicial Accounting (also called an Accounting and Contribution). This phase determines the specific financial adjustments required before the net equity is split according to the initial ownership percentages.

The goal of accounting is to restore fairness, ensuring that an owner who contributed more than their proportionate share to the property’s preservation is compensated.

Credits and Offsets: What You Can Be Reimbursed For

The court grants a co-owner credit for any necessary expenses paid that preserved or enhanced the property’s value. These are paid from the gross proceeds before the final division. These credits often include:

- Debt Service: This covers payments on the mortgage, including principal and interest (PITI), property taxes, and loan principal.

- Taxes and Insurance: Occasionally, one co-owner covers the insurance expenses and property taxes on their own.

- Necessary Maintenance and Repairs: Property maintenance requires annual inspections and ongoing repairs, which contribute to overall costs.

- Capital Improvements: These are long-term enhancements that increase the property’s value, such as renovating a kitchen or installing a modern HVAC system.

The Role of Ouster and Fair Rental Value

The court may impose an offset or charge against a co-owner’s share, often for the benefit they received by occupying the property exclusively.

- Ouster: This occurs when one co-owner forcibly or explicitly denies the other co-owner access or use of the property. When ouster is proven, the occupying owner is charged for the fair market rental value for the period of exclusive use.

- Exclusive Possession: In some jurisdictions, if one co-owner has exclusive possession, they may be charged the fair rental value. However, this charge is often used to offset credits claimed by the same occupying owner for their mortgage payments and upkeep.

The accuracy and documentation of this financial accounting are why specialized legal representation is non-negotiable.

Practical and Financial Considerations of a Partition by Sale

While the result of a forced sale is definite and final, co-owners must be prepared for the practical realities that come with the process.

1. Timeline and Costs

A contested partition action can take anywhere from 6 to 18 months, depending on the complexity of the judicial accounting and the court’s calendar.

All costs associated with the lawsuit, including the Partition Referee’s fees, legal fees, and court costs, are typically paid from the gross proceeds of the sale. While this means the filing party may incur lower out-of-pocket costs, it reduces the net equity distributed to all parties.

2. Tax Implications (A Non-Legal Disclaimer)

The IRS treats a partition by sale as a standard sale of real property. The resulting profit (the sale price minus the adjusted cost basis) may be subject to capital gains tax for all co-owners.

3. The Necessity of Specialized Legal Counsel

The property dispute, known as a Partition Action, differs significantly from everyday real estate transactions or general civil lawsuits. Hiring a lawyer in this specialized field is very important since they:

Understand the exact legal standards required to expedite the case.

- Are adept at preparing and arguing complex judicial accounting cases.

- Have experience working with local Partition Referees to ensure a fair and efficient sale.

Final Resolution: Take Action Today

The partition by sale process is the most reliable legal mechanism for ending co-ownership disputes and securing your equity. Don’t let disputes delay your financial security. Contact our skilled and qualified partition lawyer today to protect your equity and move toward a resolution that ends the conflict, delivering peace of mind and the stability you deserve.