NY Real Estate Partition Lawsuits: A Guide to Resolving Co-Ownership Disputes under RPAPL Article 9

New York real estate is arguably the most expensive and complex asset class in the United States. Whether it’s a Brooklyn brownstone, a suburban investment property, or a rural inheritance, co-ownership conflicts carry enormous financial stakes. New York’s partition law provides a clear and practical legal solution for enforcing partition: the partition action.

A partition action in New York is governed by a strict, specialized set of rules primarily found within Article 9 of the Real Property Actions and Proceedings Law (RPAPL).

The basis for appropriately terminating a joint ownership agreement and claiming your legitimate stake requires understanding RPAPL Article 9.

The Statutory Foundation: RPAPL Article 9

RPAPL Article 9 outlines the whole framework for co-ownership disputes and asset distribution in New York. This law specifies who may bring a lawsuit, where the case must be filed, and the procedures the court must follow under New York partition law.

RPAPL § 901: The Absolute Right to Partition

The cornerstone of New York Partition Law is the perception that the right to partition is absolute. According to RPAPL § 901, anybody who owns real estate as a joint tenant or tenant in common has the right to file a partition action.

- Who Can Sue (Standing): This right applies exclusively to tenants in common (owners who each have a separate share of the property) and joint tenants (owners who share the property with the right of survivorship). The term “possession” usually refers to legal ownership; hence, you do not have to actually physically live in the property to file a lawsuit.

- The Absolute Nature: A court must grant a partition unless the parties have executed a valid, binding agreement that explicitly waives or restricts the right to partition for a reasonable period. The court’s inquiry is not whether the argument is fair, but whether the legal standards for joint ownership are fulfilled.

- The Court: In the county where the property is located, a partition action must be filed in the New York State Supreme Court, the state’s principal trial court.

The Importance of Judicial Accounting (RPAPL § 945)

In New York, a partition is not just a sale; it is also a mandatory financial audit. RPAPL § 945 allows the court to adjust the distribution of proceeds to reflect the financial contributions (or lack thereof) made by the co-owners. This phase of judicial accounting is often the most heavily litigated part of the entire lawsuit.

Credits that can be claimed include:

- Mortgage principal and interest payments that are made only by the claimant.

- Payments for hazard insurance premiums and property taxes are covered.

- The costs of necessary repairs and permanent capital improvements, such as a new roof or a new boiler.

For instance, if one co-owner prevents the other from using the property through exclusive use (ouster), the other co-owner’s share may be reduced.

The court considers these factors when dividing the proceeds. This ensures that financial contributions reflect the property’s actual use. Moreover, it assures that the final payout matches each owner’s fair share of ownership.

New York Partition Lawsuit Procedure

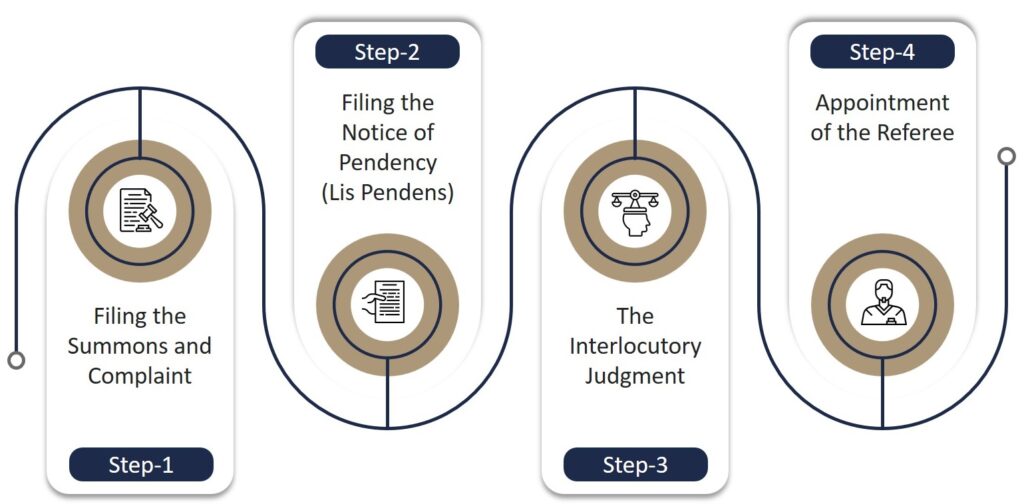

The steps required to file and conclude a partition action in the Supreme Court are highly formalized and include specific protective measures unique to New York real estate.

Step 1: Filing the Summons and Complaint

The partition process begins when a co-owner files a Summons and Complaint in court. This document should list the ownership history, the share or interest of each owner, and provide a detailed description of the property.

It must additionally declare the solutions sought, most of which are achieved through a partition by sale. Filing this action lays the groundwork for the entire case.

Step 2: Filing the Notice of Pendency (Lis Pendens)

Filing the Notice of Pendency (Lis Pendens) is an essential first step in any New York real estate matter. It alerts the public to the property’s involvement in an ongoing legal action by the county clerk.

If any owner attempts to sell, mortgage, or transfer their interest through court proceedings, the Lis Pendens ensures that the new purchaser or lender is subject to a court-ordered final decision. Failing to file and maintain it correctly can seriously compromise the case.

Step 3: The Interlocutory Judgment

The judge issues an Interlocutory Judgement of Partition once all owners have responded and the ownership shares are defined or settled. This is the court’s initial binding decision that formally:

- Confirms the legal right to partition exists.

- Determines the fractional ownership share of each party.

- Decides the method of partition (sale or physical division).

Step 4: Appointment of the Referee

If the court orders a partition by sale (which is the near-certain outcome for most New York property), the interlocutory judgment typically appoints a referee to sell. This referee is an officer of the court, typically a local attorney, who oversees the sale process.

The Referee’s Duties include:

- Obtaining an independent appraisal of the property.

- Hiring a real estate broker.

- Overseeing the marketing and closing process.

- Holding the sale proceeds in escrow until the Final Judgment is issued.

The use of a court-appointed Referee removes the sale logistics from the disputing co-owners, ensuring a transparent, court-supervised sale conducted in accordance with the court’s order.

The Precedence of Partition by Sale in New York (RPAPL § 915)

While RPAPL theoretically allows both physical division and sale, the law heavily favors sale in most developed areas of the state, especially within the five boroughs of New York City and the surrounding metropolitan counties.

RPAPL § 915: The “Great Prejudice” Standard

RPAPL § 915 instructs the court to determine whether the property “can be physically partitioned without great prejudice to the owners.” In the context of New York real estate, “great prejudice” is defined generally as any division that would result in a significant financial loss to the co-owners compared to selling the property as a single unit.

- Urban Property Reality: Without breaking zoning rules and reducing its market value, a New York City brownstone, a condo unit, or a developed multi-family house cannot actually be divided into economically usable parcels. Therefore, for 99% of improved properties, the court must order a partition by sale.

- Physical Division (Partition in Kind): This remedy is generally only viable for vast, undeveloped tracts of land in upstate or rural New York where zoning restrictions permit division and the land value is uniform.

The Impact of the UPHPA on Heirs Property

In 2021, the Uniform Partition of Heirs Property Act (UPHPA) was adopted by New York. This law addresses the conflicts involving Heirs Property. This includes real estate that has been passed down through generations without formal probate or a clear title.

Under the UPHPA, if the property qualifies as Heirs Property, the court must presume that a Partition in Kind is the fairest remedy. However, this presumption is procedural. The co-owner seeking the sale can still overcome it by providing compelling evidence that the financial loss caused by physical division would still constitute “great prejudice.”

Furthermore, the UPHPA allows non-selling owners a court-supervised right to buy out the filing owner at an appraised fair market value. This is a critical procedural layer that requires specialized legal navigation.

NYC-Specific Disputes: Multi-Unit Buildings and Valuation

Resolving conflicts over valuable, high-density properties typically requires Partition actions, which present particular legal challenges in New York City.

Inherited Brownstones and Multi-Family Buildings

A typical scenario involves inherited multi-unit buildings (such as brownstones or three-family homes) where one sibling or heir occupies one or more units. In contrast, the others seek to liquidate the asset.

- Rental Value Disputes: The judicial accounting becomes highly complex. The non-occupying co-owners will seek to charge the occupying owner the fair market rental value for the units they exclusively occupy. The occupying owner, in turn, will claim credits for all expenses (mortgage, repairs) paid. The attorney must meticulously prove both the rental value and the expenses to ensure an equitable distribution of the proceeds.

- Unequal Improvements: If one co-owner invested substantially in one unit (e.g., renovated the top floor), the accounting must determine if that investment qualifies as a Capital Improvement that entitles the investing owner to a greater share of the sale proceeds.

Partition of Commercial Real Estate

The disagreement over investment properties usually centers on strategic timing. Partners could have different perspectives on refinancing, tenant management, or whether to sell in a strong or weak market.

With partition action, you can break through this strategic deadlock, as it allows one partner to legally demand the liquidation of the property, regardless of the others’ preferences.

Cooperative vs. Condominium Partition: What Sets Them Apart

Among the most frequently misunderstood concepts in New York property law is the distinction between cooperatives and condominiums. The type of ownership dictates whether a Partition Action can be maintained under RPAPL.

a) Condominiums: Partition Applies

A condominium unit owner holds a fee simple title to their unit, granting them full legal ownership, similar to that of a house or raw land. This ownership allows the right to sell, transfer, or partition the property under New York law. Condominium owners have the same remedies and protections as any real property owner.

A condominium is considered real property, so a partition action can be filed if co-owners cannot agree. For instance, two individuals who co-own a condo as a second home or investment may be forced to partition by sale. This ensures each co-owner’s financial interest is protected through a court-supervised sale.

b) Cooperatives: Partition Does Not Apply

Cooperative owners do not own real estate. Instead, the owner holds shares in the cooperative, which entitle them to a proprietary lease for a specific apartment. This framework links the owner’s interest to corporate ownership rather than immediate ownership of the physical unit.

The requirements of RPAPL Article 9 are not met as the interest is viewed as personal property (the stock and lease) rather than real property.

Consequently, a regular partition action cannot be used to force the sale of a shared apartment. Alternative legal solutions, such as court dissolution of the co-ownership or conversion of the personal property interest, must be pursued to resolve conflicts.

An alternative legal remedy for co-owners of a cooperative in dispute is a common law action for judicial dissolution of the co-ownership partnership. This is often framed as an action to convert the personal property interest.

Though the result is comparable, the legal basis and procedural rules vary considerably.

Practical Tips for Negotiating Settlements before Litigation

Co-owners should explore settlement options to minimize time, cost, and stress before resorting to court. Start with financial records, including mortgages, taxes, property value, and capital improvements. A fair evaluation sets a foundation for fair bargaining and prevents valuation disagreements.

Think about organized buyouts or collective sales arrangements with specified conditions for payments, taxes, and responsibilities.

In commercial or multi-family properties, mediation with an unbiased third party helps to break the deadlock. To ensure safety and prevent future disputes, it is essential to document agreements in writing.

Post-Partition Considerations and Tax Implications

Co-owners have to handle distribution timing, escrowed funds, and ongoing accounting obligations following a Partition Action. Clear communication with legal counsel and the Referee is especially important as courts often hold funds until liens, taxes, and charges are paid.

Taxes, along with deductible expenses, possible capital gains, and stepped-up basis for inherited property, are of great importance. Resolving any current disputes among co-owners prevents future conflicts. Similarly, thoughtful planning for reinvestment and recordkeeping guarantees compliance and maximizes financial results.

Seek Strategic Counsel in Complex NY Partition Law- Schedule a Consultation Today

The New York statutes governing the division of co-owned property are precise, mandatory, and unforgiving of procedural errors. From properly filing the Lis Pendens to successfully proving credits in the judicial accounting, specialized legal experience is non-negotiable. This is why clients in and across New York choose us.

We are a team of seasoned New York partition attorneys dedicated to providing clients with comprehensive and quality legal representation. We strive to make the legal process smooth and stress-free, while ensuring you receive the best possible outcome.

Your equity deserves protection, not conflict. Trust us for skilled guidance and strategic support in New York partition cases. Schedule a consultation with our legal expert today.